INVESTMENT INCENTIVES SYSTEM

The new investment incentives program, which will be effective from the 1st January 2012 comprises 5 different schemes:

1- General Investment Incentive Scheme

2- Regional Investment Incentive Scheme

3- Priority Investment Incentive Scheme

4- Large Scale Investment Incentive Scheme

5- Strategic Investment Incentive Scheme

THE SUPPORT MEASURES

VAT Exemption:

In accordance with the measure, VAT is not paid for imported and/or domestically provided machinery and equipment within the scope of the investment encouragement certificate.

Customs Duty Exemption:

Customs duty is not paid for the machinery and equipment provided from abroad (imported) within the scope of the investment encouragement certificate.

Tax Deduction:

Calculation of income or corporate tax with reduced rates until the total value reaches to the amount of contribution to the investment according to envisaged rate of contribution.

Social Security Premium Support (Employer’s Share):

The measure stipulates that for the additional employment created by the investment, employer’s share of social security premium on portions of labor wages corresponding to amount of legal minimum wage will be covered by the Ministry.

Income Tax Withholding Allowance:

The measure stipulates that the income tax regarding the additional employment generated by the investment within the scope of the investment encouragement certificate will not be liable to withholding. The measure is applicable only for the investments to be made in Region 6 within the scope of an investment encouragement certificate.

Social Security Premium Support (Employee’s Share):

The measure stipulates that for the additional employment created by the investment, employee’s share of social security premium on portions of labor wages corresponding to amount of legal minimum wage will be covered by the Ministry. The measure is applicable only for the investments to be made in Region 6 within the scope of an investment encouragement certificate.

Interest Support:

Interest support, is a financial support instrument, provided for the loans with a term of at least one year obtained within the frame of the investment encouragement certificate. The measure stipulates that a certain portion of the interest/profit share regarding the loan equivalent of at most 70% of the fixed investment amount registered in the certificate will be covered by the Ministry.

Land Allocation:

Refers to allocation of land to the investments with Investment Incentive Certificates, if any in that province in accordance with the rules and principles determined by the Ministry of Finance.

VAT Refund:

VAT collected on the building & construction expenses made within the frame of strategic investments with a fixed investment amount of 500 million TL will be rebated.

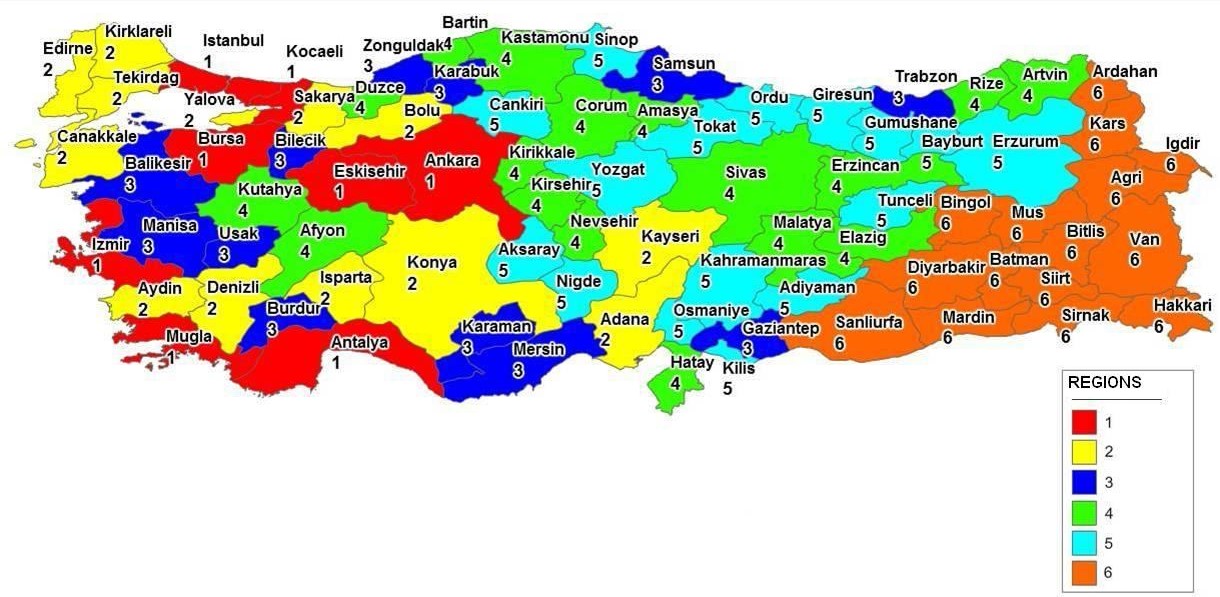

Figure 1. Map of Turkey showing the six regions for the Regional Investment Incentives Scheme.

Table 7. Support instruments to be provided within the framework of various investment incentive schemes.

| Support instruments | General | Regional | Priority | Large scale | Strategic |

| VAT exemption | x | x | x | x | x |

| Custom duty exemption | x | x | x |

x |

x |

| Tax reduction | x | x | x | x | |

| Security premium support (employer’s share) | x | x | x | x | |

| Income tax withholding allowance* | x | x | x | x | x |

| Security premium support (employee’s share)* | x | x | x | x | |

| Interest payment support† | x | x | x | ||

| Land allocation‡ | x | x | x | x | |

| VAT refund‡ | x |

* Provided that the investment is made in Region 6.

† Provided that the investment is made in Region 3, 4, 5 or 6 within the framework of the Regional Investment Incentives Scheme.

‡ Provided that the investment is made within the framework of the Strategic Investment Incentives Scheme with a minimum fixed investment amount over TRY 500 million.

Regional Investment Incentives Scheme

The sectors to be supported in each province are determined in accordance with the potential of each province, and the economies of scale and the intensity of investment support are differentiated in line with the development level of the regions.

The amount of minimum fixed investment is defined separately for each sector and each region, the lowest amount being TRY 1 million in Regions 1 and 2, and TRY 500,000 in the remaining Regions (see Table 8).

Table 8. Terms and rates of support within the Regional Investment Incentives Scheme.

| Incentive instruments | Region | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | |||

| VAT exemption | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Customs duty exemption | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Tax reduction | Rate of contribution to investment (%) | Out of OIZ* | 15 | 20 | 25 | 30 | 40 | 50 |

| Within OIZ* | 20 | 25 | 30 | 40 | 50 | 55 | ||

| Social security premium support (employer’s share) | Support period | Out of OIZ* | 2 years | 3 years | 5 years | 6 years | 7 years | 10 years |

| Within OIZ* | 3 years | 5 years | 6 years | 7 years | 10 years | 12 years | ||

| Land allocation | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Interest support | Local loans | N/A | N/A | 3 points | 4 points | 5 points | 7 points | |

| Foreign exchange/FX denomination loans | 1 point | 1 point | 2 points | 2 points | ||||

| Social security premium support (employer’s share) | N/A | N/A | N/A | N/A | N/A | 10 years | ||

| Income tax withholding allowance | N/A | N/A | N/A | N/A | N/A | 10 years | ||

*OIZ: Organized Industrial Zones.

Priority Investments Incentives Scheme

The following investment subjects have been designated as priority investments within the framework of our country’s requirements and these investments are supported by measures of Region 5 even if they are made in Regions 1, 2, 3 and 4.

- Tourism investments in Cultural and Touristic Preservation and Development Regions and thermal tourism investments,

- Mining investments,

- Railroad and maritime transportation investments,

- Defense industry investments,

- Test facilities, wind tunnel and similar investments made for automotive, space or defense industries,

- Nursery, Preschool, Primary, Middle and High School investments,

- Investments made to manufacture the products and parts designed and developed as an outcome of the R&D Projects supported by the Ministry of Science, Industry and Technology, TUBITAK and KOSGEB,

- International fairground investments with a minimum covered area of 50.000 m2,

- Motorized land vehicles key industry investments with a minimum investment amount of 300 million TL, automotive engine manufacturing investments with a minimum amount of 75 million TL and transmission components/parts and automotive electronics manufacturing investments with a minimum amount of 20 million TL,

- Investments for power generation where mines stated in the 4-b group according to 3213 Mining Law.

- Investments made to generate electricity from coal,

- Investments made to generate electricity through waste heat recovery in a facility,

- Energy efficiency investments made in existing manufacturing facilities,

- Liquefied natural gas (LNG) investments and underground gas storage investments with a minimum amount of 50 million TL,

- Investments of carbon fiber or the composite materials made from carbon fiber provided that along with carbon fiber production.

- Investments made to manufacture high-technology products classified according to OECD technology intensive definition,

- Investments made to explore mines in the permitted fields for the investors holding Mining License and Certificate

| INCENTIVE MEASURES | Terms and Rates of Supports * | |

| VAT Exemption | YES | |

| Customs Duty Exemption | YES | |

| Tax Deduction

|

Rate of Contribution to Investment (%) | 40

|

| Tax Deduction (%) | 80 | |

| Social Security Premium Support

(Employer’s Share) |

7 years | |

| Land Allocation | YES | |

| Interest Support

|

Local Loans | 5 points |

| Foreign Exchange/

FX denominated loans |

2 points | |

* Supports of Region 5 for the Investments that are made in Regions 1-5

* Supports of Region 6 for the Investments that are made in Region 6

Large-Scale Investment Incentive Scheme

Twelve investment categories (see Tables 9 and 10) are supported by the measures of the Large Scale Investment Incentive Scheme.

Table 9. Investment categories supported by the Large-Scale Investment Incentive Scheme.

| Investment subject

|

Minimum fixed investment amount

(million TRY) |

|

| 1 | Production of refined petroleum products | 1000 |

| 2 | Production of chemical products | 200 |

| 3 | Harbors and harbor services | 200 |

| 4 | a) Automotive OEM | 200 |

| b) Automotive supply industries | 50 | |

| 5 | Production of railway and tram locomotives and/or railway and tram cars | 50 |

| 6 | Transit pipeline transportation services | |

| 7 | Electronics industry | |

| 8 | Production of medical, high-precision and optical equipment | |

| 9 | Production of pharmaceuticals | |

| 10 | Production of aircraft and spacecraft and/or related parts | |

| 11 | Production of machinery (including electrical machinery and equipment) | |

| 12 | Mining (including metal production) | |

Table 10. Terms and rates of support provided within the Large-Scale Investment Incentive Scheme.

| Incentive instruments | Region | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | |||

| VAT exemption | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Customs duty exemption | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Tax reduction | Rate of contribution to investment (%) | Out of OIZ* | 25 | 30 | 35 | 40 | 50 | 60 |

| Within OIZ* | 30 | 35 | 40 | 50 | 60 | 65 | ||

| Social security premium support (employer’s share) | Support period | Out of OIZ* | 2 years | 3 years | 5 years | 6 years | 7 years | 10 years |

| Within OIZ* | 3 years | 5 years | 6 years | 7 years | 10 years | 12 years | ||

| Land allocation | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Social security premium support (employer’s share) | N/A | N/A | N/A | N/A | N/A | 10 years | ||

| Income tax withholding allowance | N/A | N/A | N/A | N/A | N/A | 10 years | ||

OIZ: Organized Industrial Zones.

The following categories of investment within the Regional and Large-Scale Investment Incentives Schemes will be supported by more favorable regional rates and terms of tax reduction and social security premium support (employer’s share):

- Investments in Organised Industrial Zones

- Joint investments to be made by at least five companies operating in the same sector with the purpose of integrating these companies to this joint investment.

Strategic Investment Incentive Scheme

On the basis of the Input Supply Strategy, this scheme aims at supporting production of intermediate and final products with high import dependence with a view to reducing current account deficit. It also targets encouraging high-tech and high-value-added investments with the potential to strengthen Turkey’s international competitiveness.

Investments meeting the following criteria are supported within the framework of the Strategic Investment Incentive Scheme (see Table 11):

- Production of intermediate and final goods with high import dependence, of which >50% of these goods are supplied by imports

- Minimum investment of TRY 50 million

- Creation of ≥40% value added (this condition is not applicable to investment in production of refined petroleum or petrochemicals)

- Import amount of at least US$ 50 million for goods to be produced in the last 1-year period (this condition is not applicable to goods with no domestic production).

Table 11. Terms and rates of supports provided within the Strategic Investment Incentives Scheme.

| Incentive instruments | Region | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | ||

| VAT exemption | Yes | ||||||

| Customs duty exemption | Yes | ||||||

| Tax reduction | Rate of contribution to investment (%) | 50 | |||||

| Social security premium support | Support period | 7 years | |||||

| (Employer’s share) | (10 years for Region 6) | ||||||

| Land allocation | Yes | ||||||

| Interest payment support | Local loans | 5 points | |||||

| Foreign exchange /FX denomination loans | 2 points | ||||||

| Social security premium support (employee’s share) | 10 years (only for investments in Region 6) | ||||||

| Income tax withholding allowance | 10 years (only for investments in Region 6) | ||||||

| VAT refund | Yes (only for investment of TRY ≥500 million) | ||||||

Incentives for R&D and Design Centers

If at least 15 personnel are employed in a research and development (R&D) center and 10 personnel are employed in design center, the law provides special incentives projects. However, required number of personnel has been determined as 30 employees in the production of motor vehicles, aircraft, spacecraft and related machinery. The effects of these incentives will remain until 2024:

- 100% deduction of R&D expenditure from the tax base if the number of researchers exceeds 500; then, in addition to the 100% deduction, half of the R&D expenditure increase incurred in the operational year compared to the previous year will also be deducted

- Income withholding tax exemption for employees (effective until 31 December 2023)

- 50% of social security premium exemption for employers (effective until 31 December 2023)

- Stamp duty exemption for applicable documents

- Custom duty exemption for imported products will be used in these centres

- Techno-initiative capital for new scientists, up to TRY 500,000

- Deduction from the tax base of certain funds granted by public bodies and international organizations.

Advantages in technology development zones

Technology development zones (TDZs) are areas designed to support R&D activities and attract investment in high-tech fields. The following tax exemptions are available for TDZs:

- Offices ready to rent, and infrastructure facilities provided

- Profits derived from software development and R&D activities are exempt from income and corporate taxes until 31 December 2023

- Deliveries of application software produced exclusively in TDZs are exempt from VAT until 31 December 2023

- Wages of researchers, along with software and R&D personnel employed in the TDZ, are exempt from personal income tax until 31 December 2023

- 50% of the employer’s share of social security premiums will be paid by the government until 31 December 2024.

Advantages of free zones

Free zones are special sites considered to be outside the customs area, although they are within the political borders of the country. These zones are designed to increase the number of export-focused investments. Legal and administrative regulations in the commercial, financial, and economic fields that are applicable within the customs area are either not implemented or partially implemented in the free zones. The advantages of free zones are:

- 100% exemption from customs duties and other assorted duties

- 100% exemption from corporate income tax for manufacturing companies

- 100% exemption from VAT and special consumption tax

- 100% exemption from income tax on employees’ salaries (for companies that export ≥85% of the FOB (Free On Board) value of the goods they produce in the free zones)

- Goods can remain in free zones for an unlimited period

- Companies are free to transfer profits from free zones to abroad as well as to Turkey, without restrictions.

Advantages of organized industrial zones

Organized industrial zones (OIZs) are designed to allow companies to operate within an investor-friendly environment with ready-to-use infrastructure and social facilities. The existing infrastructure provided in OIZs includes roads, water, natural gas, electricity, communications and waste treatment. The advantages of OIZs are:

- No VAT for land acquisitions

- Exemption from real estate duty for 5 years starting from the construction of the plant

- Low water, natural gas, and telecommunication costs

- For unification and/or separation of plots, no tax to be paid

- Exemption from municipality tax for construction and usage of the plant

- Exemption from the municipality tax on solid waste if the OIZ does not benefit from the municipality service.

TUBITAK and TTGV

TUBITAK (Scientific and Technological Research Council of Turkey) and TTGV (Turkish Technology Development Foundation) both compensate or grant R&D-related expenses and capital loans for R&D projects. The following projects are eligible for TUBITAK incentives:

- Concept development

- Technological research

- Technical feasibility research

- Laboratory studies in the translation of a concept into a design

- Design and sketching studies

- Prototype production

- Construction of pilot facilities

- Test production

- Patent and licence studies

- Activities to resolve post-sale problems arising from product design.

Government support for small and medium-sized enterprises

SMEs are defined as companies employing <250 employees and earning TRY <25 million in revenue or turnover per year.

Incentives granted to SMEs include:

- Exemption from custom duties

- VAT exemption for imported and domestically purchased machinery and equipment

- Credit allocation from the budget

- Credit guarantee support.

In order to meet financial needs of SMEs, a TRY 1 billion fund was transferred to the Credit Guarantee Fund (KGF) by the Treasury to create credit capacity worth TRY 10 billion. The guarantee limit is TRY 1 million per SME and TRY 1.5 million for the relevant risk group. KGF covers up to 80% of the loan.

KOSGEB support to SMEs

The Small and Medium Sized Industry Development Organization (KOSGEB) makes significant contributions to strengthening SMEs through various support instruments in financing, R&D, common facilities, market research, investment site, marketing, export and training.

State aid for exports

The main aims of this scheme are to encourage exports and to increase the competitiveness of companies in international markets. This specific package mainly covers R&D activities, market research, participation in exhibitions and international fairs, and expenditure for patents, trademarks and industrial design.